NFTs have been all the rage lately. From Beeple’s $69 million sale to Taco Bell tacos you can’t actually eat, digital art seems to be in its heyday. NFTs allow for artists to actually transfer ownership of an original piece of digital art. Why does this matter?

Think about traditional art for a moment. You can put a magnet of Monet’s Water Lilies or van Gogh’s The Starry Night on your fridge, but that doesn’t mean the original hangs in your kitchen. Owning the original brush strokes is an entirely different situation than a magnet bought at the art museum gift shop.

In the digital space, copies of files appear precisely the same on the surface. Owning the original art file is much harder to document. Enter NFTs: non-fungible tokens. These little units transfer ownership along the Ethereum blockchain, providing irrefutable proof of ownership. A piece of digital art with an NFT on it is verifiably owned thanks to all the documentation coded directly into the associated NFT. It also supports resale processes and can automatically funnel royalties back to the artist.

NFTs provide digital artists a way to be compensated for their work and protect their original files. Digital art is the primary asset that the market is responding to the technical concept of NFTs, but there’s nothing in their structure that limits their application to only digital art. We’re predicting that NFTs are here to stay, and this application of the technology is just the first foothold.

The great adventure

To get a better understanding of how this emerging transactional technology works from the user’s perspective, we embarked on an experiment. From the MotionMobs development team, Taylor Smith, Interactive Developer, created an original piece of digital art and attached an NFT, and from the MotionMobs strategy team, Emily Hart, COO, set out to buy it.

Creating an NFT

Play-by-play commentary by Taylor Smith

To start with, I’m not very deep into cryptocurrencies at all. I pay attention to the news when it’s big enough to reach me via the tech channels I pay attention to. I don’t “hodl” or hold cryptocurrency for a period of time. I don’t care about prices going “to the moon.” The only way I’ve been a participant in this space at all is that I received a bundle of Stellar Lumens (XLM), or another form of cryptocurrency, as part of an airdrop involving Keybase that had happened a while back.

NFTs were a new interesting wrinkle in the world of cryptocurrencies when I heard about them a month or so ago right as they started making big news. After doing some research on NFTs and the potential that they might hold, I decided to see what the process of selling an NFT looks like from the creator’s perspective. I quickly put together something that could pass as art (much of the world of NFT art is passable art in my opinion), and decided to find a place to sell it.

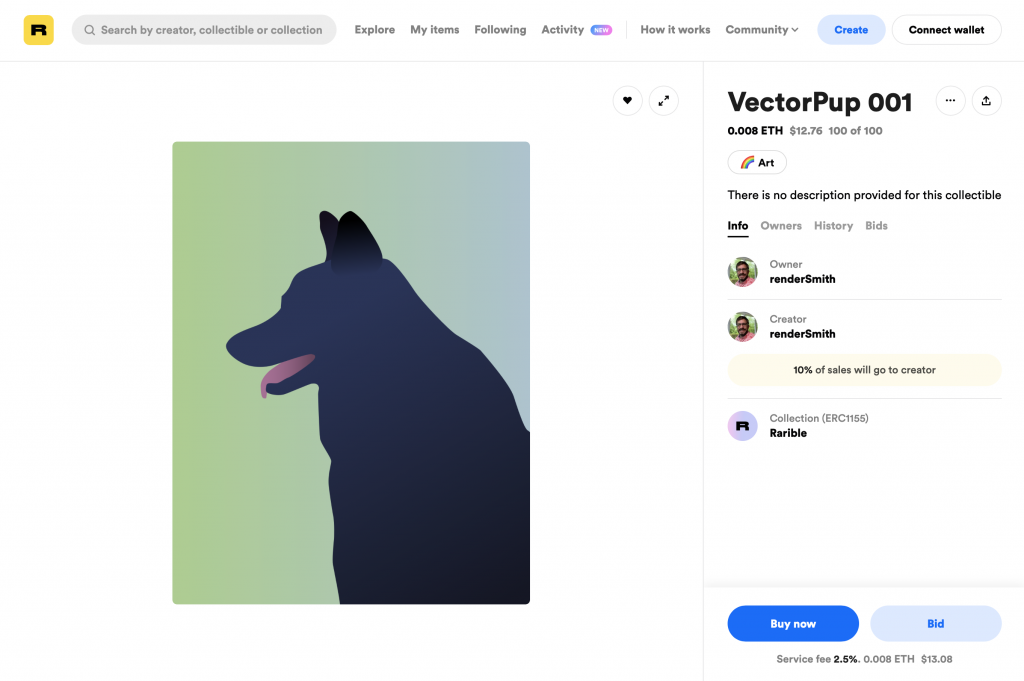

Many of the current NFT art marketplaces are curated, with the site owners finding and selecting known or upcoming artists to feature on their site. Rarible, apart from verifying certain accounts, allows anybody to upload images, animated GIFs, videos, or audio for sale on their marketplace without curation. So, off to Rarible I went with VectorPup, ready for the world (and for purchase).

It was too easy. I didn’t even have to create an account! Once I completed the very simple upload form, I clicked “Create Item” and up popped MetaMask, a software cryptocurrency wallet. In my earlier research I’d already set up MetaMask in my browser, but didn’t yet have any ETH on it. I realized in order to set up the NFT, I’d need to pay for the setup, including the gas fees (the cost to perform the transaction on the blockchain) to do so. I had assumed this was what the service fees charged by Rarible were for, but they are not. It was too easy, indeed.

I proceeded to Kraken, a cryptocurrency exchange,to try and purchase enough ETH to get things going. In the process of setting up my account there, though, things got to the point where I wasn’t fully comfortable. Handing over things like my social security number and images of my drivers license just to upload an image for an experiment like this made me nervous. It’s very similar to the process of opening a real investment account, but with something that’s much less tangible (and less widely accepted) than traditional government issued currency, or fiat, as is the lingo for it in the world of cryptocurrencies.

Convert, don’t buy

I looked around a bit more for an easier, less invasive solution, and had the thought that I might be able to exchange some of my XLM for ETH. I then realized that I could convert XLM into another currency, just not straight to ETH. So I traded XLM for Bitcoin, then traded those Bitcoin to ETH, paying transaction fees along the way. I ended up with enough ETH to reach my goal. I then moved those to my wallet (another transaction with fees, if I remember correctly) and back to Rarible I went to upload my VectorPup art.

I tried the upload again, this time with ETH in my wallet ready to go. After approving the transaction and paying gas fees that were valued between $60 and $70 USD at the time, I had an NFT of the VectorPup up on the market ready to sell!

As someone who has only lightly dabbled in cryptocurrencies via XLM, the steps required to get something up on a marketplace were almost enough to stop me from trying. At the moment, the process and required knowledge to create an NFT for sale make the NFT market very much an insider’s place to try to get into.

With all of that said, though, I’m not sure what I’ve got now that I’m in…

Acquiring an NFT

Play-by-play commentary by Emily Hart

I have never personally transacted with cryptocurrency. This was part of our motivation to have me attempt the purchase because I’m a true crypto-beginner, which is representative of most members of the general public and most of MotionMobs’ clients.

First task is to identify an item to purchase. That part was easy. I miss office dogs while working remotely, and Taylor’s VectorPup offers me a remote office dog. Priced at 0.008 ETH, it’s a steal of a deal (wink, wink). Time to purchase some original digital art and acquire my first NFT. I find VectorPup on Rarible and click “Buy Now.”

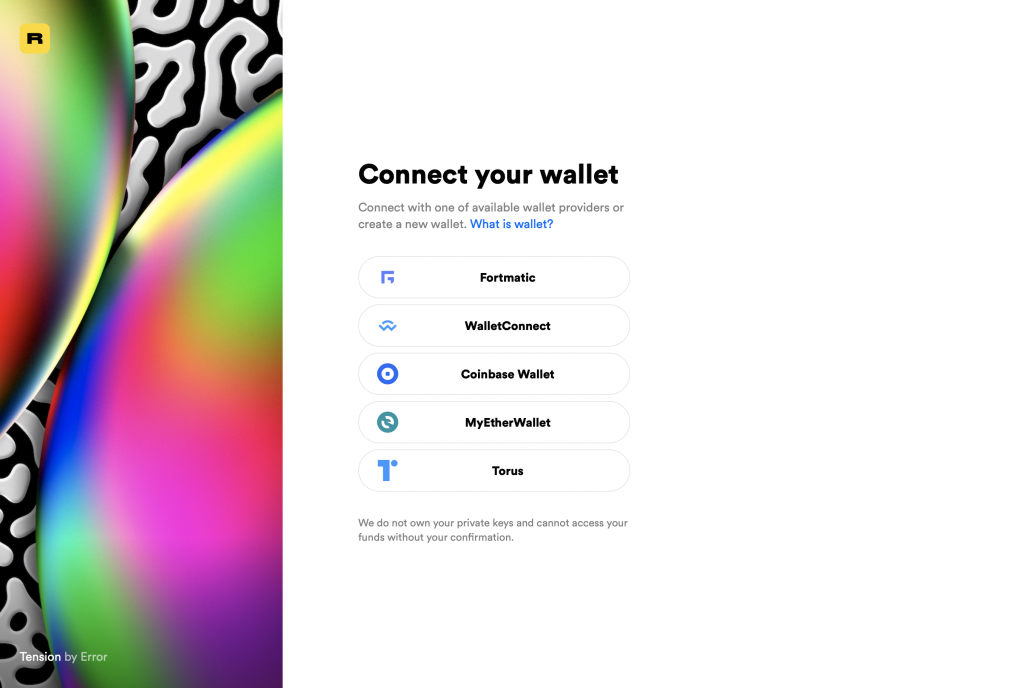

I’m immediately faced with the first purchase hurdle. Before I can purchase, I need to connect a wallet. There are five options listed on the site: Fortmatic, WalletConnect, Coinbase Wallet, MyEtherWallet, and Torus. I have no idea why I would choose any one of these over the others.

After a quick consult with Taylor and Wade Garrett, MotionMobs’ Front End Developer, both who have some experience with NFTs and cryptocurrency, I learned I should look into MetaMask and/or Kraken. Both of which are noticeably not listed on Rarible’s options.

Another large piece of advice I got was to not fall into the $RARI trap, Rarible’s own currency, which fluctuates and surges in value, similar to how Uber’s pricing changes. So I stick with the ETH and the associated fees. Screenshots for MetaMask wallet indicate perhaps I can transact through it with Apple Pay, which seems like a win to me. The fox logo is sort of cute, too, so I download the app.

Creating a new wallet isn’t difficult. It’s a lot like setting up an encrypted messaging app like Keybase, but it’s probably a bit of a challenge for anyone not familiar with secret keys or device authorization. I repeat the process to set it up on the browser on my desktop, too.

I return to the VectorPup listing on Rarible, and my MetaMask account shows up. Success! It’s the little things, right?

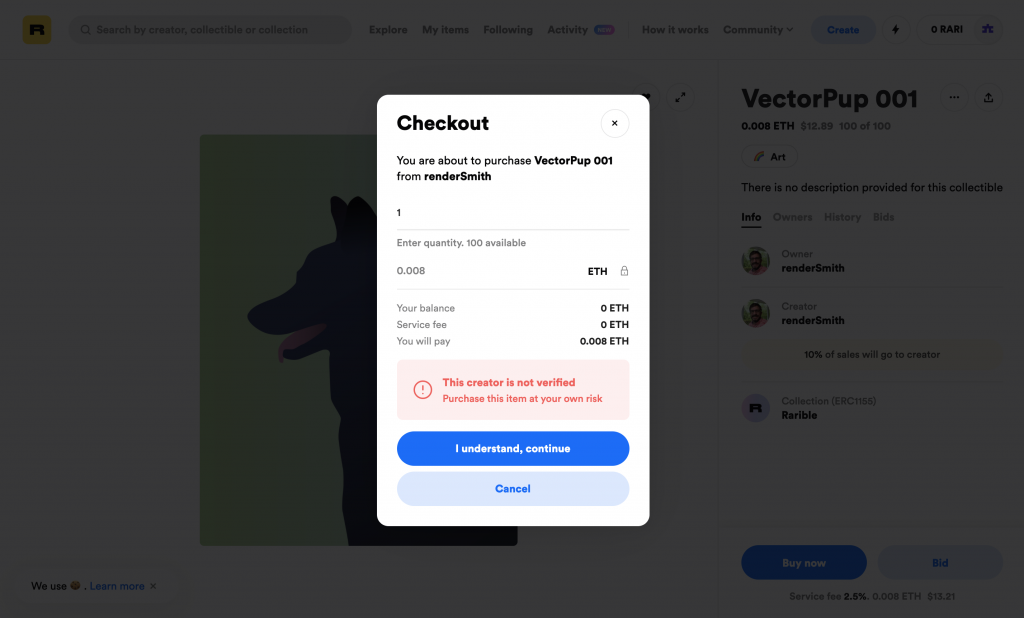

Seeing as I’m more business-like than a programmer, I’m going to stick to my typical purchasing behaviors. I click “Buy Now” on VectorPup (again). I get a warning that the seller isn’t verified, but I’ll accept that risk because I know him and the VectorPup subject personally.

VectorPup is listed at 0.008 ETH, which is currently about $12.89. I don’t have sufficient funds to pay, but I know that. I quickly glance at the things that look like errors here and mostly ignore them because I don’t have any money in my wallet. Turns out this was a poor choice.

Buying ETH

Back to the MetaMask mobile app to buy some Ethereum via Apple Pay. Minimum purchase is $50, so I guess I’m exchanging more currency than I intend to spend. There’s a $5 fee on my transaction from Wyre.

Well, shoot. I can only use Apple Cash, not just my usual Apple Pay transactions. So much for my hope that I could expense this exercise on the company credit card. Now I have to go load my Apple Cash wallet so I can convert into my new MetaMask wallet so I can pay for VectorPup.

Personal rant moment: I don’t usually maintain a balance in Apple Cash. Now I’m on the phone with my bank, who is connecting to Visa, to approve my transaction. If this was not a specific work task for research purposes, I would absolutely give up. VectorPup is not worth this. Nonetheless, I stick with it.

Due to the warnings I’ve heard and seen about fees, I load $65 from my bank account into Apple Cash to be sure I can cover the transaction fee into MetaMask. I attempt the Apple Pay transaction in MetaMask again. It fails. No explanation.

I’ve seen some comments on the MetaMask listing in the App Store about failed transactions that later post through as successful, so I’m going to give it a few minutes. My Apple Watch reminds me I’ve been trying to purchase VectorPup for an hour and I need to stand, so I do.

Five minutes pass. I have my Apple Watch stand credit, but still no Ether. The transaction is listed in my history as officially failed. I try again. Another failed transaction.

I’ve found a new angle to try. Transak, an on/off ramp for cryptocurrency transactions with bank accounts, says I can buy Ethereum using a credit card. After four attempts to remove $200 USD and replace it with $25, it finally appears to accept my amount. This should award me with 0.0151903 ETH. I verify my email address with Transak and hope for the best.

Apparently that doesn’t matter one bit because Alabama doesn’t allow card payments for ETH via Transak. Back to square one. I still have no Ether.

I try Coinbase Wallet next. The sign-up process is not quite as security focused as MetaMask was. It feels more like setting up app access to a bank account. Only problem is that the bank account I dedicated for this experiment isn’t supported by Plaid, and I’d prefer not to connect my actual primary bank account for VectorPup. Will they take a debit card instead? I am in luck – They do!

But my purchase limit for buying ETH with my debit card is $0.00. Fan-freaking-tastic.

I return to MetaMask and try the Apple Pay transaction again, just for fun. It still fails.

At this point, I have attempted three avenues for purchasing ETH with USD: Apple Pay, Transak, and Coinbase’s debit card option. None have succeeded.

Back to VectorPup

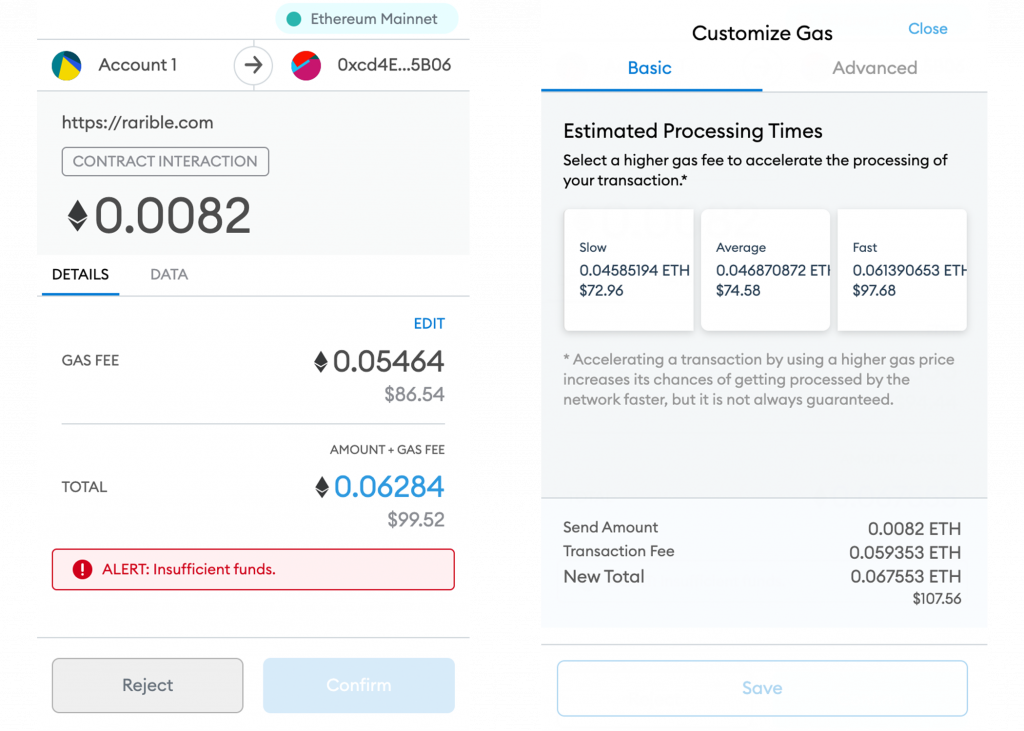

I return to Rarible to review what looked like error messages about not having sufficient funds for purchase to read those a bit closer. Now I realize my mistake. There’s a “gas fee” on my transaction, which is payment to the network to process my transaction. The slowest gas fee option on my purchase is about 0.045 ETH, which is around $74 USD. VectorPup now costs me at least $87 to purchase.

Even if the Apple Pay transaction would have gone through, my $65 would not cover the cost of actually purchasing VectorPup, nor would the bulk of my purchase even end up in my teammate’s wallet. A bulk of the price of my prized VectorPup consists of these gas fees.

Momentary reflection

I suddenly find myself glad that my assets are still all USD and not locked up in ETH. I have USD that I can spend. I understand how apps work. Yet here I am, with two wallets and no ETH.

As a buyer, I don’t yet have a compelling reason to pay what amounts to nearly $75 in “transactional” fees to prove my ownership of a piece of digital art my coworker made. I can see where $75 to ensure security and ownership of original art is reasonable if I’m purchasing art worth several thousands of dollars. It feels like insurance at that point.

Gas fees to validate a transaction along the Ethereum blockchain are absolutely prohibitive for small purchases, though. I went into this experiment willing to pay $25 or $35 to Taylor to buy an original copy of VectorPup with an NFT. The Ethereum blockchain simply can’t transact reasonably at that price point.

Larger implications

Let’s be clear here: Companies transact in the currency in which they do business. People transact in currency that is readily available to them. All businesses know that the more difficult it is for customers to purchase goods or services, the fewer they will sell.

Engaging with cryptocurrency has an astronomical barrier to entry. We live in a world where you can purchase from international retailers online with a credit card that automatically converts currency when required. While NFTs are exciting and rewarding for high-profile digital artists, the system doesn’t yet provide an easy access point for a novice buyer.

However, due to the structure of NFTs and the way they document ownership of assets beautifully, it’s safe to assume that NFTs are here to stay. This is emerging technology, though, and there’s a lot of work to be done to the Ethereum blockchain before the average business may consider selling products validated by NFTs.

Want to talk more about NFTs? Drop us a note. We’re happy to navigate this with you.